Imagine a bustling farmer’s market brimming with fresh produce. You arrive, eager to snag juicy tomatoes, but discover that the prices are set incredibly low. Instead of a frenzy of activity, you see only a few shoppers, and the vendors look discouraged. This scenario, while uncommon in real life, highlights the strange outcome of setting a price floor below the equilibrium price – a seemingly advantageous move that actually creates a market void.

Image: articles.outlier.org

This concept, often discussed in economic textbooks, can feel abstract. But understanding the consequences of setting a price floor below equilibrium is crucial for anyone involved in pricing strategies, from small businesses to government agencies. This article will explore the effects of such a scenario and explain why it’s a move that often backfires, leading to reduced market activity and potential economic inefficiencies.

A Price Floor: Understanding the Basics

A price floor, in simple terms, represents a minimum price that sellers are legally allowed to charge for a particular good or service. Picture it as a safety net for producers, ensuring they receive a certain level of compensation. While seemingly beneficial, its effectiveness largely hinges on where it is placed relative to the equilibrium price.

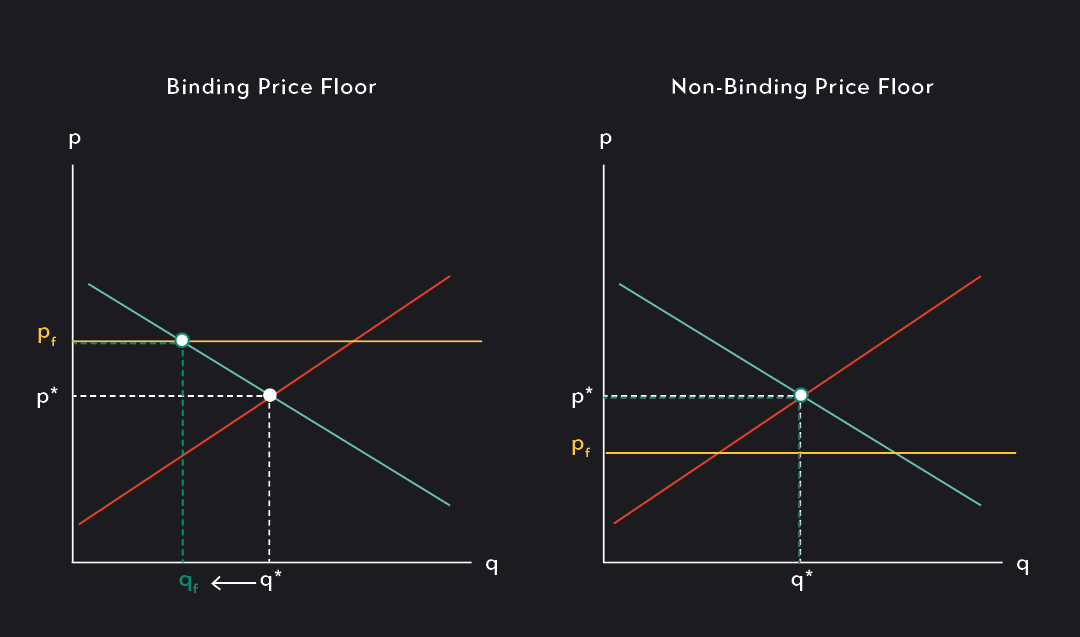

The equilibrium price is the point where the forces of supply and demand perfectly balance. At this point, the quantity demanded equals the quantity supplied, creating a harmonious market state. When a price floor is set above the equilibrium price, it becomes impactful, potentially limiting demand and creating a surplus. However, when set below the equilibrium price, the situation becomes peculiar.

The Curious Case of a Price Floor Below Equilibrium

Now, imagine a price floor set below the equilibrium price. At first glance, it seems like a win-win situation: consumers would enjoy lower prices, and producers still receive their minimum guaranteed wage. However, reality proves more complex. The market, in essence, ignores the price floor, as the equilibrium price already naturally guarantees a higher price for producers.

In such a scenario, the price floor doesn’t actually affect the market price. The equilibrium price prevails, and the price floor becomes a “non-binding constraint,” meaning it doesn’t influence market participants’ behavior. This is because the equilibrium price already serves as a natural floor, surpassing the formally imposed minimum.

The Implications: A Dampened Market

The most notable consequence of a price floor set below the equilibrium price is a lack of impact. The market operates as if the price floor doesn’t exist, and its presence becomes purely theoretical. This lack of influence is a direct result of the equilibrium price acting as a natural floor, rendering the official price floor redundant.

This situation might lead to confusion and frustration for producers, who may initially be misled by the government intervention. They might expect an increase in demand and revenue due to the price floor, only to find that the market remains unaffected. The lack of impact on the market also negates the potential for increased revenue and profit promised with a price floor.

One might argue that the non-binding price floor is a harmless intervention, creating no negative consequences. However, this viewpoint overlooks a significant aspect: the opportunity cost. Implementing and enforcing a price floor requires resources, including administrative manpower and potential legal expenses. These resources could be better utilized elsewhere to directly address market inefficiencies or support producers in more meaningful ways.

Image: www.chegg.com

Addressing the Opportunity Cost

Instead of using resources for a non-binding price floor, policymakers could invest in programs that directly benefit producers. These could include subsidies, tax breaks, or investment in research and development for their industries. These measures would likely yield more tangible results than an ineffective price floor below the equilibrium price.

It’s also essential to recognize the importance of market forces. While government intervention sometimes plays a vital role in ensuring fair competition and addressing market failures, it shouldn’t be used to artificially manipulate prices below the natural equilibrium. The market, when allowed to function freely, naturally finds its equilibrium price, which reflects the true value of goods and services.

Expert Advice for Producers

For producers who are considering advocating for a price floor, it’s essential to first understand the equilibrium price of their market. If the price floor is set below the equilibrium price, it’s unlikely to have any significant impact. Instead, concentrate efforts on factors that directly influence the equilibrium price, such as improving the quality of goods and services, reducing production costs, or increasing demand through marketing campaigns.

While the allure of a government-imposed price floor might seem tempting, it’s crucial to prioritize strategies that create real value in the market. A focus on enhancing existing operations and exploring opportunities for growth will lead to more sustainable and profitable results in the long run.

FAQ: Price Floors and Equilibrium Prices

Q: What is the ideal position for a price floor?

A: A price floor should ideally be set above the equilibrium price to have a tangible impact on the market. This will limit the quantity demanded and lead to a surplus, potentially benefiting producers.

Q: Why is a price floor below equilibrium ineffective?

A: The market naturally gravitates towards the equilibrium price, where supply and demand balance. If a price floor is below this point, it has no effect as the equilibrium price already acts as a natural floor, surpassing the official minimum.

Q: Can a price floor ever be beneficial?

A: Yes, although rare, price floors can be beneficial in specific scenarios, like protecting producers in essential industries or preventing unfair exploitation of workers. However, it’s crucial to understand the potential downsides and carefully consider the consequences.

A Price Floor Set Below The Equilibrium Price Results In

Conclusion: Navigating the Market with Understanding

A price floor set below the equilibrium price becomes a theoretical construct, a bureaucratic formality with little impact on market activity. Understanding this subtle, yet significant, aspect of price floors is crucial for those involved in economic policy and business strategies. Instead of focusing on interventions that might not achieve desired outcomes, policymakers and producers should explore solutions that directly address market inefficiencies and create genuine value in the marketplace.

Are you interested in learning more about the complex interactions between price floors and market equilibrium? Share your thoughts and questions in the comments below. Let’s continue the discussion.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)