Have you ever wondered how government policies can affect the price of goods and services? A price floor, a minimum price set by the government, can have a significant impact on the market, especially on the well-being of consumers. One of the key concepts to understand when analyzing price floors is consumer surplus, a measure of consumer satisfaction. This article will delve into the intricate world of consumer surplus, explaining how to calculate it in the presence of a price floor. We’ll demystify this economic concept and unveil the implications for both consumers and producers.

Image: www.tessshebaylo.com

Imagine going to the farmers’ market and finding out that the government has mandated a minimum price for apples, even though the supply is abundant and the market price would naturally be lower. This is precisely the scenario where a price floor comes into play, and it prompts the crucial question: how does it affect consumer surplus? In this article, we’ll explore the intricacies of calculating consumer surplus in the presence of a price floor, uncovering the impact of government intervention on consumer well-being.

Understanding Consumer Surplus

Consumer surplus is a fundamental concept in economics that measures the additional benefit consumers receive from consuming a good or service beyond the price they pay. Imagine you’re willing to pay $10 for a slice of pizza, but you only end up paying $7. The $3 difference represents your consumer surplus, the extra value you received.

Think of it as a hidden bonus – a delightful surprise that adds to your overall satisfaction. Consumer surplus is a key indicator of consumer welfare, as it highlights the difference between what consumers are willing to pay and what they actually pay.

The Impact of a Price Floor

A price floor, as we mentioned earlier, is a minimum price set by the government for a particular good or service. The goal is often to protect producers by ensuring they receive a fair price for their goods. However, the impact of a price floor can be more complex than it might seem.

When a price floor is set above the equilibrium price – the price at which supply and demand are balanced – it might create a surplus in the market. This means that producers are willing to supply more goods than consumers are willing to buy at the higher price. When this happens, some consumers may be priced out of the market, leading to a decrease in consumer surplus.

Calculating Consumer Surplus with a Price Floor

To understand how to calculate consumer surplus with a price floor, let’s first visualize a simple model:

- Demand Curve: Represents the different quantities of a good that consumers are willing to buy at different prices. It’s typically downward sloping because as the price increases, consumers tend to purchase less.

- Supply Curve: Represents the different quantities that producers are willing to sell at different prices, and it typically slopes upward because at higher prices, producers are more willing to supply more goods.

- Equilibrium Price: This intersection of the supply and demand curve.

- Price Floor: A minimum price set above the equilibrium price.

Now, let’s dive into the steps of calculating consumer surplus:

1. Identify the Relevant Area

- In the absence of a price floor, consumer surplus is represented by the triangular area between the demand curve and the equilibrium price.

- With a price floor, the relevant area for calculating consumer surplus becomes smaller. The triangle now extends from the demand curve down to the price floor, representing the portion of the market where consumers are buying goods at the mandated price.

2. Calculate the Area of the Triangle

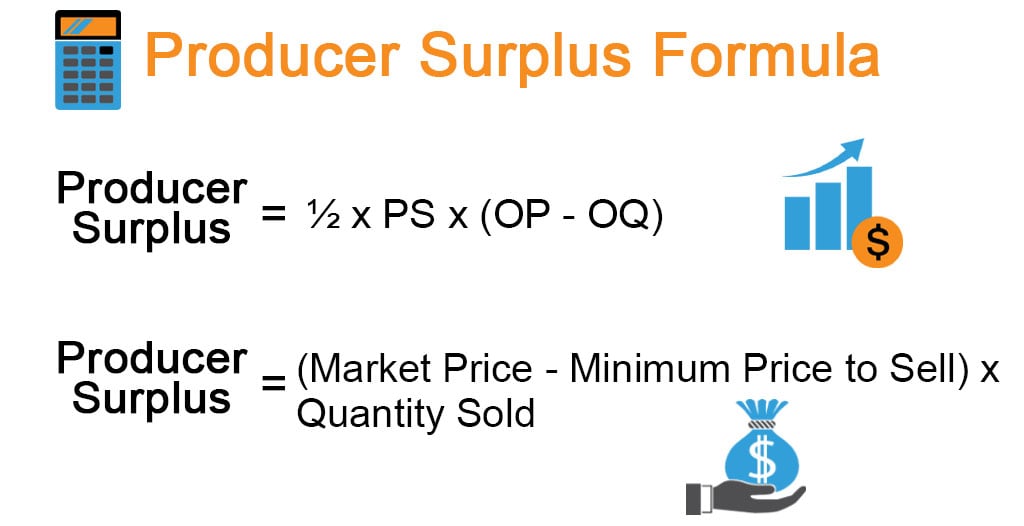

- Consumer surplus can be calculated using the formula for the area of a triangle: (1/2) base height.

- In this context, the base of the triangle is the quantity demanded at the price floor, and the height is the difference between the maximum price consumers are willing to pay (as indicated by the demand curve) and the price floor.

3. Interpret the Results

- A lower consumer surplus with a price floor indicates that the price intervention has reduced consumer welfare.

- Consumers are effectively paying a higher price than they would in a free market, resulting in a diminished benefit.

Image: axis.schoolsinterop.org

Real-World Examples

Imagine a government imposing a minimum wage for agricultural workers. Although this might benefit workers who can find jobs, it could also lead to a decrease in consumer surplus for those who purchase agricultural products. This is because farmers might need to increase the price of their produce to cover the higher labor costs, making it more expensive for consumers.

Similarly, consider a minimum price on milk. If the set price is higher than what consumers are willing to pay, many might opt for alternative beverages, reducing their consumption of milk and leading to a lower consumer surplus.

Expert Insights

As you can see, calculating consumer surplus with a price floor is more than just a theoretical exercise. It’s a vital tool for assessing the impact of government policies on consumer welfare. Economists like Nobel laureate Milton Friedman have argued that price floors tend to create deadweight losses, reducing overall economic efficiency.

Actionable Tips

- Stay informed about government policies and their potential impact on your purchasing power.

- Make informed choices as a consumer, weighing the benefits and drawbacks of different products and services within the context of price floors.

- Advocate for policies that promote consumer welfare and minimize unintended consequences.

How To Calculate Consumer Surplus With A Price Floor

Conclusion

Understanding how to calculate consumer surplus with a price floor is crucial for comprehending the effects of government intervention on market dynamics and consumer well-being. By recognizing the potential impact of price floors, we can make more informed decisions as consumers and advocate for policies that promote economic efficiency and consumer welfare. The information discussed here is just the starting point for deeper exploration. Continue your journey of learning about economics and the complexities of government interventions, and remember that knowledge empowers you to make informed choices and shape a more prosperous future.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)