Imagine you’re 17 years old, excited to get your first job at the local ice cream shop. You picture yourself scooping up sweet treats, making new friends, and earning your own money. However, your dreams are quickly met with reality when you learn the minimum wage is significantly lower than you expected. You wonder, “Is this fair? Shouldn’t I be paid a living wage for my hard work?” This seemingly simple question touches upon a complex economic concept: the price floor.

Image: www.chegg.com

Governments often implement price floors, a minimum price set by the government for a particular good or service, with the goal of protecting producers or workers from exploitation. While the concept might seem straightforward, the implications of a government-imposed price floor can be far-reaching, impacting both producers and consumers. Understanding the dynamics of price floors in the real world is crucial for grasping the potential benefits and unintended consequences they bring.

The Minimum Wage: A Price Floor for Labor

The most common and perhaps the most recognizable example of a government-imposed price floor is the minimum wage. It’s a legal mandate that sets the lowest hourly wage that employers can pay their workers. The idea behind the minimum wage is simple: to ensure a basic standard of living and prevent workers from being exploited.

For many, the minimum wage represents a lifeline. It provides a financial safety net for low-income workers, allowing them to afford essential goods and services like food, housing, and healthcare. Studies have shown that minimum wage increases can lead to improvements in poverty rates and overall economic well-being for low-wage workers.

However, the impact of minimum wage policies can be a heated topic of debate. Some argue that raising the minimum wage can lead to job losses as businesses struggle to afford the higher labor costs. They argue that businesses might cut hours, automate jobs, or even close down entirely, ultimately hurting the very workers it’s designed to protect.

The Economics of Price Floors

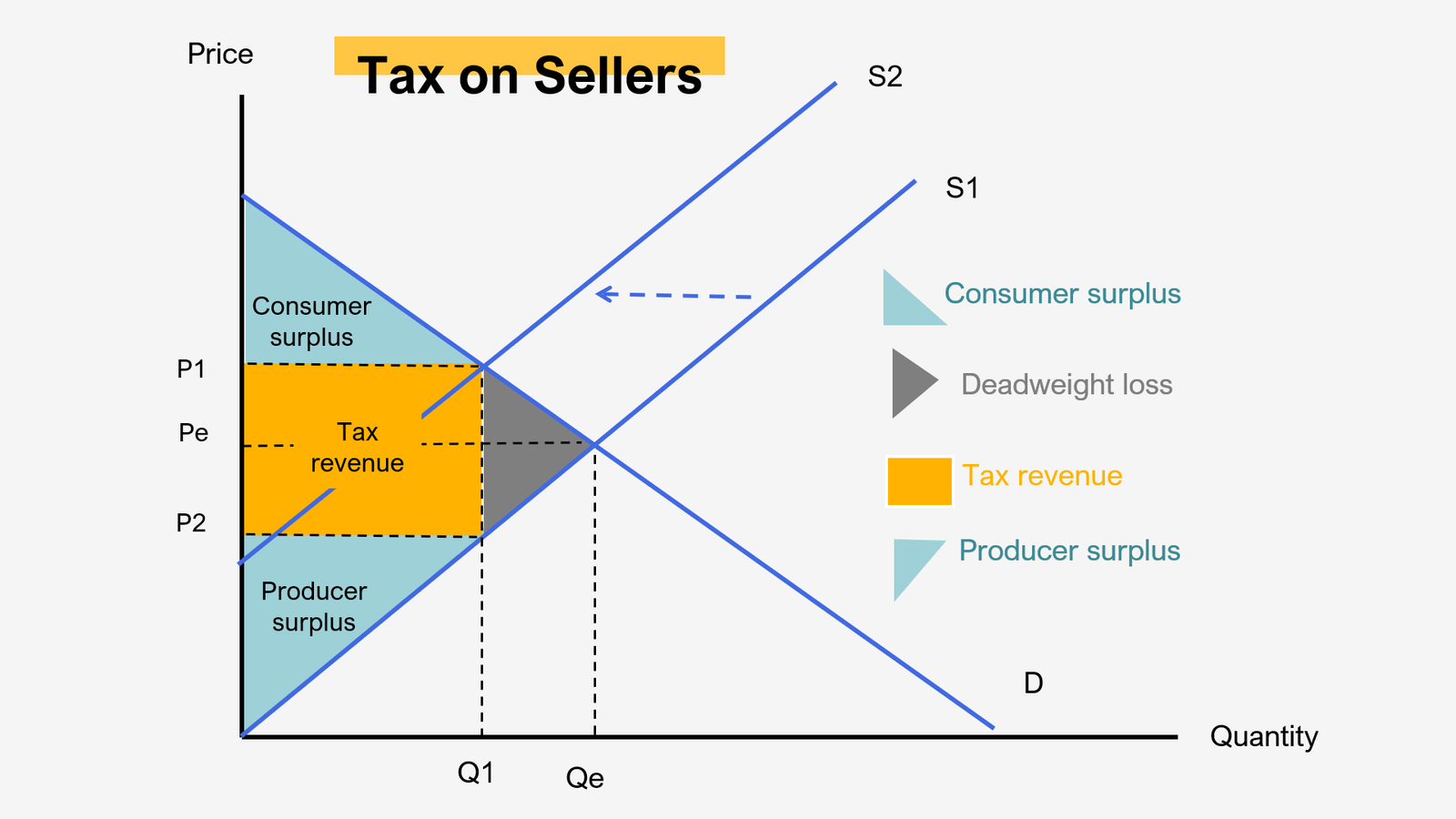

To understand the potential consequences of a price floor, it’s helpful to visualize its impact on the supply and demand curve. The supply curve represents the relationship between the price of a good or service and the quantity suppliers are willing to offer. The demand curve, on the other hand, represents the relationship between the price and the quantity consumers are willing to buy.

When a government imposes a price floor that is higher than the equilibrium price (the point where supply and demand intersect), it creates a surplus. This surplus occurs because the higher price discourages consumers from buying as much, while it encourages suppliers to produce more.

In the case of the minimum wage, this surplus manifests as unemployment. The higher wage discourages businesses from hiring as many workers, leading to an excess supply of labor. This surplus of labor puts pressure on workers to accept lower wages, as they compete for jobs. Ultimately, the minimum wage can lead to higher unemployment rates, particularly among low-skilled workers.

The Minimum Wage in Action: A Case Study of Seattle

Seattle’s experience with raising its minimum wage in 2016 provides a real-world example of the impact of price floors. The city implemented a phased-in increase, raising the minimum wage to $15 per hour by 2021.

Initial studies showed that the minimum wage increase did not lead to widespread job losses as some economists predicted. However, the results were not uniform across all industries. Low-wage industries like restaurants and retail saw a slight decrease in employment, while other sectors, such as healthcare, experienced a modest increase in employment.

The Seattle minimum wage increase also highlighted the potential impact on worker mobility. The city saw a significant increase in workers moving from low-wage industries to higher-wage ones. This suggests that while the minimum wage increase did not lead to widespread job losses, it did encourage workers to seek more lucrative opportunities, potentially benefitting them in the long run.

Image: wiewird.com

Beyond the Minimum Wage: Other Examples of Price Floors

Although the minimum wage is perhaps the most prominent example of a price floor, other government-imposed price floors exist in various sectors. For example, governments sometimes set minimum prices for agricultural products to protect farmers from volatile market conditions. This can help ensure that farmers receive a fair income for their crops.

Governments may also set price floors for essential goods like medicine. This is often done to encourage the production of essential drugs and ensure they are accessible to everyone. However, this policy can also lead to higher costs for consumers and potentially hinder innovation in pharmaceutical industries.

Navigating the Debate: Finding the Right Balance

The debate surrounding government-imposed price floors, especially the minimum wage, rests on complex economic and social considerations. The minimum wage aims to ensure a decent standard of living for low-income workers but can also lead to unintended consequences like job losses or pressure on businesses to automate jobs.

Finding the right balance requires nuanced discussion and a willingness to consider all sides of the issue. There is no one-size-fits-all solution, and the impact of price floors will vary depending on the specific context and the overall economic environment.

Expert Insights and Actionable Tips

When considering the impact of price floors, it’s essential to consult experts in economics and labor. Their insights can provide valuable context and help us understand the complex trade-offs involved. For example, economists like David Card and Alan Krueger have conducted extensive research on the effects of minimum wage increases, providing compelling evidence that they do not necessarily lead to job losses.

As individuals, we can support policies aimed at raising the minimum wage while also exploring alternative solutions to address issues like unemployment and worker exploitation. We can advocate for job training programs and initiatives that equip workers with the skills they need to thrive in a competitive job market.

A Good Example Of A Government-Imposed Price Floor Is

Conclusion

Government-imposed price floors, like the minimum wage, are a complex economic tool designed to protect workers and ensure a basic standard of living. While they can be beneficial in addressing issues like poverty and exploitation, they also come with potential drawbacks, such as job losses or higher prices for consumers.

Understanding the multifaceted implications of price floors is crucial for informed policy decisions. It requires an awareness of the economic dynamics at play, a willingness to consider diverse perspectives, and a commitment to finding solutions that benefit both workers and businesses. By engaging in thoughtful discourse and seeking evidence-based solutions, we can work towards a more equitable and sustainable economic system for all.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)