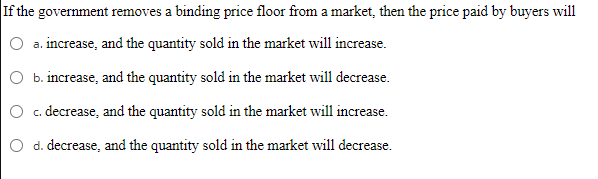

Imagine a bustling marketplace teeming with vendors, each vying for the attention of eager customers. Now, picture a government decree mandating a minimum price for every single item sold. In this scenario, would the market thrive, or would it be stifled by the artificial limitations imposed by the price floor? This hypothetical scenario captures the essence of what happens when a government removes a binding price floor – a complex economic policy with significant implications for producers, consumers, and the market as a whole.

Image: www.coursehero.com

The term “price floor” might sound abstract, but its impact is felt in very real ways. A binding price floor is a minimum price set by a government or regulatory body, often imposed to protect producers, ensure a minimum income for workers, or maintain a stable market. When this floor is removed, the market is free to fluctuate naturally, driven by the forces of supply and demand. While this can seem like a simple shift, the removal of a binding price floor can trigger a cascade of changes, impacting production, pricing, and ultimately, the affordability and availability of goods and services for consumers.

Unveiling the Dynamics of Removing a Price Floor: An Economic Exploration

To understand the ramifications of removing a binding price floor, we must first delve into its history and the key principles that shape its impact.

From Regulation to Deregulation: A Historical Perspective

Throughout history, governments have employed price floors as a mechanism to control markets and protect certain sectors of the economy. The most well-known example is the minimum wage, designed to safeguard workers from exploitation by ensuring a livable income. Other examples include:

- Agricultural Price Supports: Governments have implemented price floors for agricultural commodities like wheat, corn, and dairy products to ensure a stable income for farmers.

- Rent Control: Some cities have enacted rent control policies, setting a maximum price landlords can charge for rental properties.

- Minimum Prices for Essential Goods: During times of war or crisis, governments often set minimum prices for essential items, like fuel or food, to prevent excessive price fluctuations and ensure equitable access.

However, over time, economists and policymakers began to question the efficacy and potential downsides of these price floors. The removal of such regulations – a move often referred to as “deregulation” – has become a recurring debate in economic circles.

The Invisible Hand at Work: Supply and Demand in Action

The core concept underpinning economics is the interaction of supply and demand. When a binding price floor is in place, it prevents the market from naturally reaching its equilibrium point – the price at which the quantity supplied by producers equals the quantity demanded by consumers.

Here’s how this plays out:

- Surplus: If the price floor is set above the equilibrium price (as in the image below), the quantity supplied will exceed the quantity demanded. This leads to a surplus, as producers are willing to produce more at the higher price, but consumers are not willing to buy as much.

- Distortion: The price floor creates a distortion in the market, preventing it from reaching its natural equilibrium. This can lead to inefficiencies, as resources are allocated in a way that doesn’t reflect true market conditions.

Image depicting equilibrium price, equilibrium quantity, price floor, surplus and shortage:

[Insert image here – ensure image is non-copyrighted and appropriate]

Image: www.chegg.com

The Implications of Removal: Shifting Dynamics

When a binding price floor is removed, the market is freed to respond to the true forces of supply and demand, creating a chain reaction with both positive and negative consequences:

- Lower Prices: Removing a price floor allows prices to fall to their natural equilibrium, potentially making goods and services more affordable for consumers.

- Increased Competition: As prices decrease, it becomes easier for new entrants to enter the market, leading to increased competition, innovation, and efficiency.

- Reduced Surplus: The removal of the price floor can lead to a reduction in the surplus, as producers adjust their production levels to meet the actual demand. This can be beneficial for resource allocation and efficiency.

- Potential Challenges: While the removal of the price floor can create economic benefits, it can also present challenges. Producers who relied on the artificial price support may face financial hardship, and some consumers may find it harder to afford goods and services if prices fall below their previous levels.

The Case of Minimum Wage

The removal of minimum wage laws is a complex and controversial issue. Advocates argue that it can lead to job creation, as businesses can afford to hire more workers at lower wages. They also point to potential economic benefits for consumers as lower labor costs can translate into lower prices for goods and services.

However, opponents of minimum wage removal argue that it can exacerbate income inequality and harm low-wage workers, particularly those with limited skills or experience. They point to potential negative impacts on worker morale, job security, and living standards.

Navigating the Removal of a Price Floor: Insights and Actionable Tips

The removal of a binding price floor is a complex economic decision with far-reaching consequences. Understanding the dynamics of supply and demand, the potential benefits and challenges, and the specific context of the market in question is crucial for making informed decisions.

Expert Insights:

- Dr. Emily Carter, Economist: “Removing a price floor can create a more dynamic and efficient market, but it’s crucial to carefully assess the potential impact on producers and consumers, especially vulnerable groups.”

- Professor David Henderson, Economist: “The decision to remove a price floor should be guided by careful analysis, considering factors like the elasticity of supply and demand, the presence of alternative employment opportunities for workers, and potential social costs.”

Actionable Tips:

- Stay informed: Keep abreast of the latest economic trends and policy developments related to price floors and deregulation.

- Engage in constructive dialogue: Participate in discussions, share your perspective, and advocate for policies that promote fairness and economic well-being for all.

- Support businesses: Patronize businesses that are adapting positively to market changes and offering competitive prices and quality products.

When The Government Removes A Binding Price Floor

A Call to Action: Shaping a More Equitable and Prosperous Future

The removal of a binding price floor is both an opportunity and a challenge. It demands a nuanced understanding of the complexities of economics, a commitment to fairness, and a willingness to navigate the evolving landscape of the market. By staying informed, participating in discussions, and supporting businesses that thrive in a free-market environment, we can contribute to a more equitable and prosperous future for all.

As we move forward, let us embrace the challenges and opportunities presented by removing price floors, working together to create a market that is both efficient and inclusive, where producers and consumers alike can benefit from the forces of supply and demand.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)