Imagine walking into your favorite grocery store and finding that the price of your favorite fruit is significantly higher than usual. While you might be tempted to buy it anyway, you likely feel a little cheated, knowing you’re paying more than you should. This scenario highlights a real-world example of how price floors, a government-imposed minimum price for a good or service, can impact consumer surplus, the difference between what consumers are willing to pay for a good and what they actually pay. This article will delve into the intricate relationship between binding price floors and consumer surplus, providing a comprehensive understanding of how this economic concept affects consumers.

Image: www.e-education.psu.edu

Understanding the dynamics between price floors and consumer surplus requires grasping a few key economic concepts. We’ll explore the definition and history of price floors, the impact of binding price floors on consumer surplus, and how this relationship translates into real-world scenarios. We’ll also discuss strategies for navigating the impact of price floors and answer common questions.

Understanding Price Floors and Their Impact on Consumer Surplus

Price Floors: A Defining Introduction

A price floor is a government-mandated minimum price that sellers can charge for a good or service. These policies are typically implemented to protect producers, ensuring they receive a fair price for their products. Minimum wages, often considered the most prominent example of a price floor, are designed to ensure workers earn a decent living. However, the consequences of price floors can extend beyond the intended benefits, impacting consumer surplus.

Binding Price Floors: A Deeper Dive

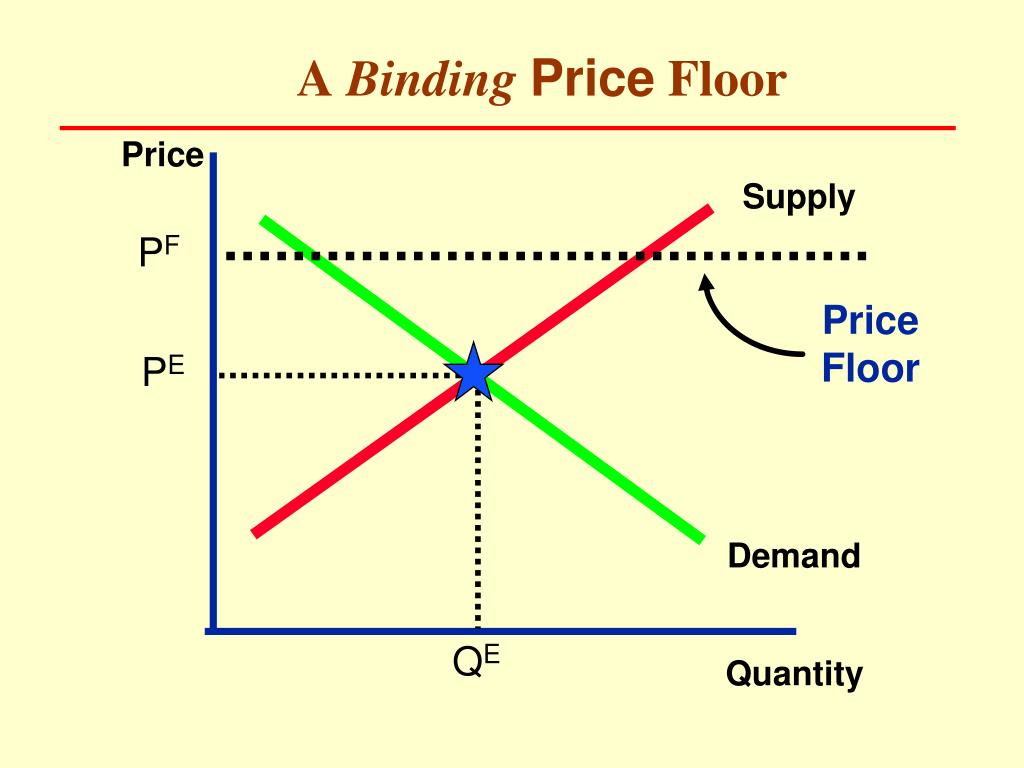

A price floor is considered binding when it is set above the equilibrium price, the point where supply and demand intersect. In this scenario, the price floor becomes effective and impacts market outcomes. When a price floor is binding, consumers are forced to pay a higher price than they would in a free market, leading to a reduction in consumer surplus. Here’s a visual representation:

Image: admin.itprice.com

The Impact of Binding Price Floors on Consumer Surplus

Consumer surplus represents the net benefit consumers gain from purchasing a good or service. It is the difference between the maximum price consumers are willing to pay and the actual price they pay. When a binding price floor is in place, the price increases, shifting the consumer surplus downwards. This is because consumers are now forced to pay more for the good or service, reducing their overall benefit.

The following graph illustrates this phenomenon. The black line represents the demand curve, the blue line represents the supply curve, and the red line represents the price floor. The equilibrium price is at the point where the supply and demand curves intersect. When a price floor is set above the equilibrium price, the quantity demanded decreases, while the quantity supplied increases, leading to a surplus. The shaded area between the equilibrium price and the price floor represents the reduction in consumer surplus.

One notable aspect of binding price floors is that they can negatively impact consumer welfare. To illustrate this, consider the example of a farmer who sets a higher minimum price for milk to protect their income. While this might benefit farmers, it could harm consumers who are forced to pay more for milk. Consumers who were previously willing to pay the market price for milk might now be priced out of the market, potentially reducing their consumption and overall well-being.

Real-World Examples of Binding Price Floors

The impact of binding price floors can be observed in various industries. One prominent example is the minimum wage, designed to protect workers. While it ensures a minimum income for workers, it can also lead to job losses if employers are unable to afford the higher wage. This situation occurs because businesses may be forced to reduce their workforce or raise prices, further reducing consumer surplus.

Another example is the farm subsidies imposed by many governments to protect farmers from low prices. These subsidies, effectively a form of price floor, can ensure that farmers earn a decent income but can also lead to higher food prices for consumers. Understanding these examples can help you grasp the complex interactions between price floors, consumer surplus, and market dynamics.

Latest Trends and Developments

The debate surrounding price floors is constantly evolving, with recent trends focusing on the impact of minimum wages on employment and economic growth. Researchers are examining the effectiveness of minimum wage increases in improving worker welfare without harming economic growth.

In addition to academic research, social media platforms and forums play a growing role in shaping public opinion about price floors. These online spaces offer opportunities for diverse viewpoints to be shared and debated, contributing to a deeper understanding of both the benefits and drawbacks of these policies. Following these conversations can provide valuable insights into the evolving understanding of price floors and their impact on consumer surplus.

Tips and Expert Advice

As consumers navigate the impact of binding price floors, it is essential to understand the implications and potential consequences. Here are a few tips to help you manage this economic phenomenon:

1. **Stay informed:** By tracking the latest news and research related to price floors, you can be aware of any potential changes or policies that could affect your purchasing decisions. This includes following relevant publications, participating in online forums, and engaging with experts in the field.

2. **Explore alternatives:** When faced with a binding price floor, remember that consumers have options. You can explore alternative products or brands that are not subject to the price floor or seek out discounted options.

3. **Support equitable policies:** As a consumer, you can advocate for equitable policies that protect both producers and consumers. By engaging in public discourse, participating in advocacy groups, or contacting your elected officials, you can contribute to a more balanced economic landscape.

Frequently Asked Questions (FAQs)

Q1: How do binding price floors affect market efficiency?

Binding price floors can create inefficiencies in the market by distorting the price mechanism, leading to surplus. This surplus represents goods and services that are produced but not consumed, representing a misallocation of resources. The price floor can also discourage new entrants to the market, as it reduces the potential profits associated with producing and selling the good.

Q2: What are the potential consequences of a binding price floor?

Binding price floors can lead to several consequences, including reduced consumer surplus, deadweight loss, black markets, and reduced competition. It can also hamper economic growth by discouraging investment and innovation.

Q3: Are there any circumstances where binding price floors can be beneficial?

In a few instances, price floors can have positive consequences. They can provide essential goods and services to low-income households, for instance, through the provision of subsidized housing or food programs. However, the effectiveness of such interventions must be carefully evaluated to ensure they are not overly burdensome on the economy or consumers.

Q4: How can policymakers mitigate the negative impacts of binding price floors?

Policymakers can employ strategies to mitigate the negative impacts of binding price floors by implementing them carefully and thoughtfully. This involves setting them at appropriate levels, monitoring their impact, and engaging in clear communication with consumers. Additionally, policymakers can consider alternative measures, such as subsidies or tax credits, to support producers without negatively impacting consumers.

When A Binding Price Floor Exists Consumer Surplus Will:

Conclusion

The relationship between binding price floors and consumer surplus is a complex one with implications for both producers and consumers. By understanding the dynamics of these policies and their impact on market outcomes, consumers can make informed decisions and advocate for policies that promote a fair and efficient market environment. Are you interested in learning more about the impact of price floors and other economic policies? Share your thoughts and comments below!

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)