Have you ever been anxiously waiting for a crucial benefit payment, only to find yourself frustrated with a lack of information about its whereabouts? Picture this: You rely on Direct Express for your monthly benefits, but you’re unsure when the funds will arrive in your account. The suspense can be nerve-wracking, leaving you feeling a bit lost and helpless. This is where understanding the ins and outs of the Direct Express tracking card comes in handy.

Image: www.unemploymentpua.com

The Direct Express tracking card offers a lifeline to beneficiaries, providing a simple and convenient way to monitor their benefit payments. It’s a powerful tool that empowers you to take control of your finances, ensuring you can manage your money with confidence. So, let’s dive deeper into the world of Direct Express tracking cards and uncover the benefits, features, and tips that can make your life easier.

What is a Direct Express Tracking Card?

The Direct Express debit card is a prepaid card specifically designed for recipients of federal benefits, such as Social Security, Supplemental Security Income (SSI), Veterans Affairs (VA) benefits, and more. It’s a secure and reliable method for receiving your benefits electronically, offering a convenient way to access your funds.

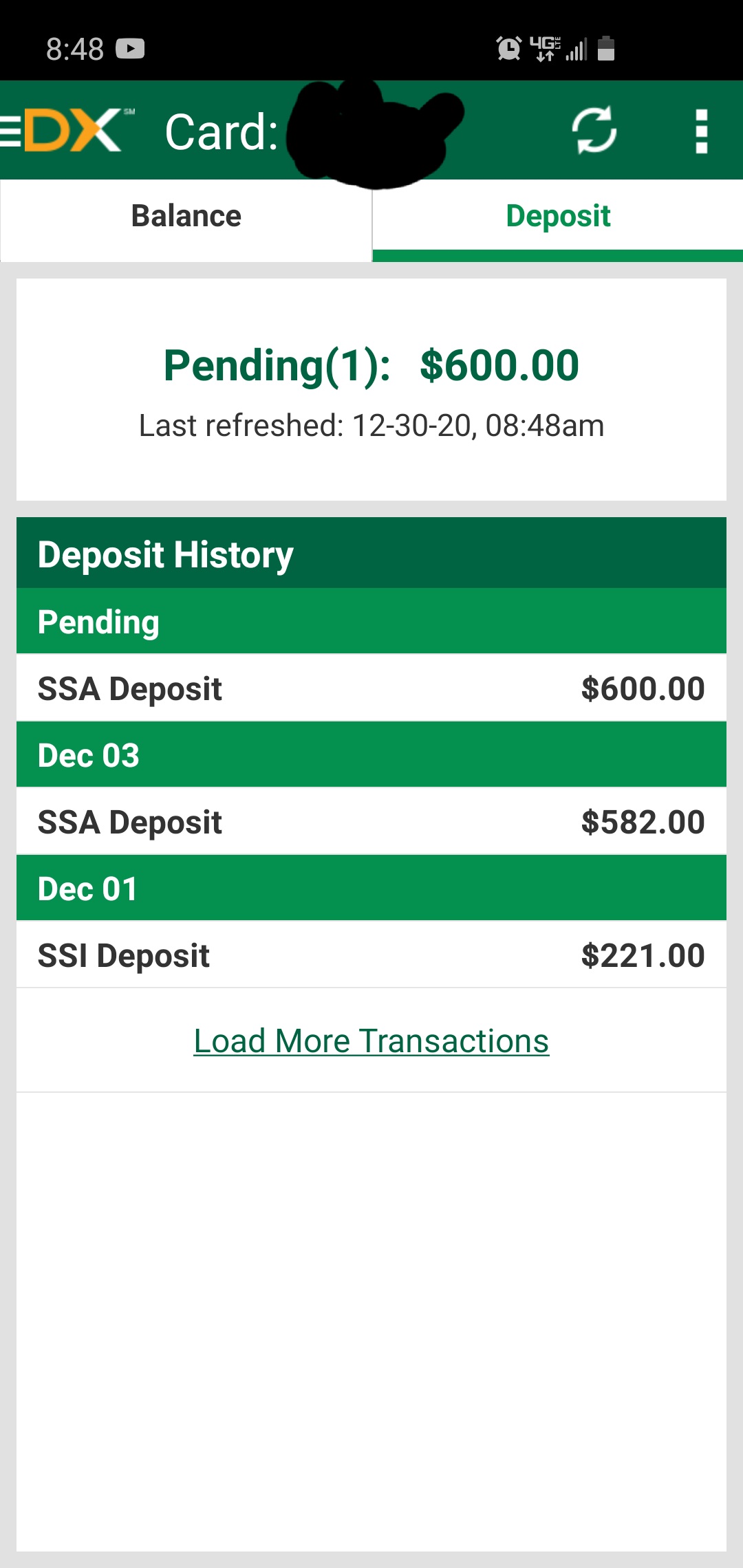

The Direct Express tracking card is a crucial component of this system, providing you with real-time insights into your benefit payments. It lets you monitor the status of your benefits, track transactions, and even set up alerts for specific events. Whether you’re concerned about a delayed payment or simply want to stay informed about your account activity, the Direct Express tracking card empowers you to stay in control.

Understanding the Basics of Direct Express Tracking

Direct Express is a government-sponsored program managed by Comerica Bank, designed to provide a safe and efficient way for beneficiaries to receive their benefits. The Direct Express debit card is a vital part of the program, functioning as a prepaid account that allows you to access your funds directly. Here’s how it works, from the initial enrollment to accessing your funds:

Enrollment and Card Activation:

Once you’re eligible for federal benefits, you’ll receive a Direct Express debit card in the mail. To activate your card and start using it, you’ll need to follow the instructions provided on the card or in the enclosed documentation. The activation process typically involves a phone call or online method, requiring basic personal details for verification.

Image: directexpress.info

Tracking Your Benefits:

The Direct Express tracking card enables you to monitor your benefit payments through various methods. The most common option is the Direct Express website or mobile app. These platforms provide a secure portal to access your account information, view transaction history, and set up alerts for specific actions, such as low balances or pending deposits.

Using Your Direct Express Card:

Your Direct Express debit card works just like a regular debit card, allowing you to make purchases at stores, withdraw cash from ATMs, and pay bills online. The card is accepted at most merchants that accept Mastercard, offering wide acceptance across the country.

Exploring the Benefits of a Direct Express Tracking Card

Choosing the Direct Express tracking card as your primary method of receiving benefits comes with several advantages:

Convenience and Flexibility:

The Direct Express card offers unparalleled convenience, eliminating the need for physical checks or trips to the bank. You can access your benefits anytime, anywhere, as long as there’s an ATM or merchant accepting Mastercard. This flexibility is particularly beneficial for individuals with limited mobility or those who prefer to manage their finances online.

Secure and Reliable Payment:

Security is a paramount priority for Direct Express. The cards are equipped with advanced security features, including EMV chip technology and fraud detection systems, to protect your funds from unauthorized access. The program also offers a dedicated customer support team to address any issues or concerns you might encounter.

Budgeting and Financial Management:

The Direct Express tracking card can enhance your financial management. By accessing your transaction history and balance information, you can create detailed budgets and monitor your spending habits. This level of transparency empowers you to make informed financial decisions and manage your money effectively.

Latest Trends and Developments: Direct Express Evolution

The Direct Express program is continuously evolving to meet the changing needs of beneficiaries. Recent developments include:

Mobile App Enhancement:

The Direct Express mobile app has seen significant improvements, offering a more intuitive and user-friendly interface. You can now perform a wide range of tasks through the app, such as checking your balance, viewing transaction history, setting up payment reminders, and even reporting a lost or stolen card.

Expanded Merchant Acceptance:

Direct Express is actively working to expand the network of merchants that accept the card. This means that you’ll have greater access to goods and services, with more options for spending your benefits.

Fraud Prevention Measures:

With the rise of electronic fraud, Direct Express is prioritizing fraud prevention measures. The program incorporates advanced security systems, including biometrics and multi-factor authentication, to safeguard against unauthorized access and identity theft.

Expert Tips for Managing Your Direct Express Tracking Card

Managing your Direct Express card effectively requires some best practices:

Keep Your PIN Secure:

Your Personal Identification Number (PIN) is crucial for accessing your Direct Express card. Keep your PIN confidential and never share it with anyone. It’s recommended to memorize your PIN and avoid writing it down on any documents that could be lost or stolen.

Monitor Your Account Regularly:

Just like with any bank account, regular account monitoring is essential. Review your transaction history and balance promptly to detect any fraudulent activity or errors. Report any suspicious transactions or discrepancies immediately to the Direct Express customer support team.

Protect Your Card:

Keep your Direct Express card in a safe place and avoid carrying it around unnecessarily. If you lose your card, report it lost or stolen immediately to prevent unauthorized use.

Direct Express Tracking Card FAQs:

What is the Direct Express Customer Support Number?

You can contact the Direct Express customer service hotline at 1-800-333-0660 to address any questions or concerns regarding your account or card.

Can I use my Direct Express card outside of the United States?

No, the Direct Express card cannot be used outside of the United States. Its usage is limited to domestic transactions only.

Can I add money to my Direct Express card?

You cannot add money to your Direct Express card. It’s strictly a prepaid account that only receives federal benefit payments.

What happens if I forget my PIN?

If you forget your PIN, you can call the Direct Express customer service hotline at 1-800-333-0660. They can assist you with resetting your PIN over the phone.

Direct Express Tracking Card

Conclusion: Maximizing Your Direct Express Experience

The Direct Express tracking card offers a reliable and user-friendly system for accessing your federal benefits. By understanding the basics of card management, exploring the benefits of the system, and following expert tips, you can maximize your experience with the Direct Express program. As the program continues to evolve, it’s essential to stay informed about the latest trends and developments to ensure you’re getting the most out of your benefits.

Are you currently using a Direct Express tracking card? Do you have any helpful tips or experiences you’d like to share with other beneficiaries? We’d love to hear your insights and experiences in the comments section below.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)