Imagine this: You’ve meticulously filled out your Colorado state tax return, double-checked every number, and are ready to send it off. But then, a daunting question arises – where exactly do you mail it? The answer isn’t always obvious, especially with Colorado’s ever-evolving tax system. Fear not, this article will guide you through the process, ensuring your return reaches its destination safely and on time.

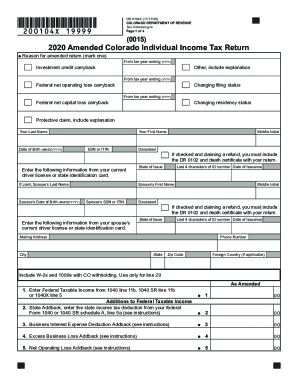

Image: www.pdffiller.com

Navigating the world of taxes can be challenging enough, but sending your tax return to the right address can significantly impact your experience. Sending it to the wrong place could lead to delays, penalties, or even the rejection of your return. This guide will provide clear, accurate information, empowering you to submit your Colorado state tax return with confidence.

Understanding Colorado Tax Return Addresses

First things first, understanding where your return needs to go depends on your situation. Colorado utilizes different addresses depending on whether you are sending a paper return or an electronic one, and even the year of the filing matters. Here’s a breakdown of the essential information:

Mailing Your Paper Tax Return

For those opting for a paper filing, the address for your Colorado state tax return will depend on the specific year you are filing for.

- For returns filed in 2023:

- Colorado Department of Revenue:

- PO Box 173427

- Denver, CO 80217-3427

- Colorado Department of Revenue:

- For returns filed in 2022 and earlier:

- Colorado Department of Revenue:

- PO Box 173320

- Denver, CO 80217-3320

- Colorado Department of Revenue:

Remember to always verify the correct address with the Colorado Department of Revenue website. They update their information regularly, ensuring you send your return to the right location.

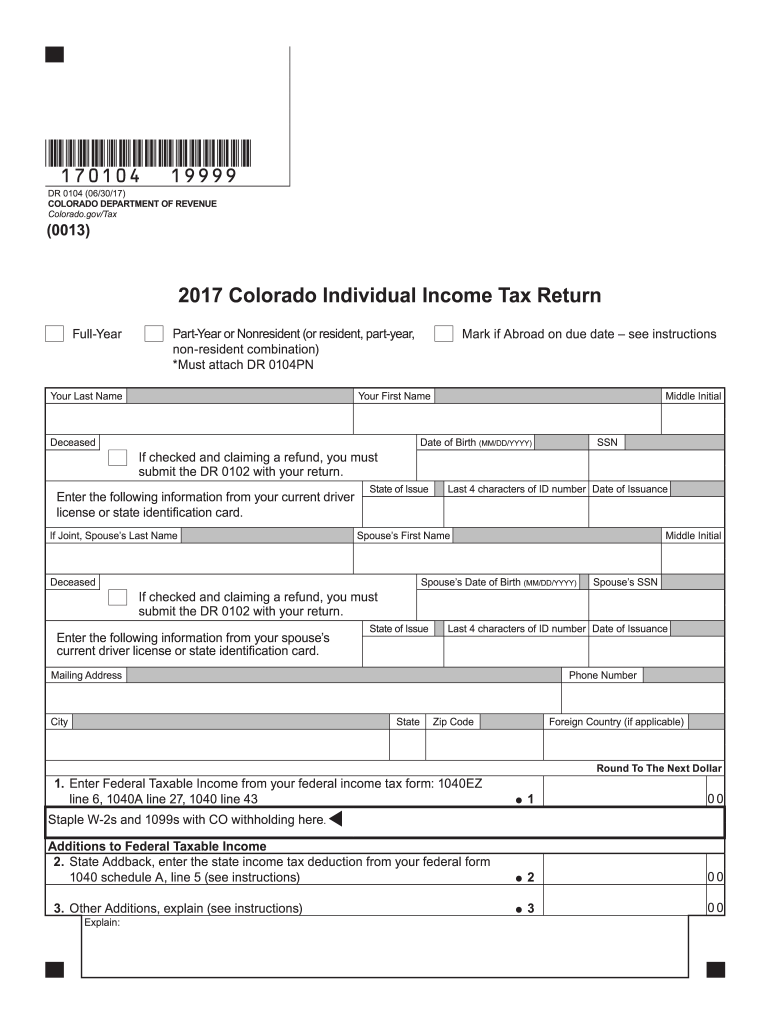

Electronic Filing – The Easier Route

Electronic filing, also known as e-filing, has significantly streamlined the tax preparation process. It’s convenient, fast, and reduces the risk of errors that can occur with paper returns. When e-filing, you don’t need to worry about mailing addresses. Instead, your tax preparation software or online service submits your return directly to the Colorado Department of Revenue, removing the need for physical postage.

Image: www.dochub.com

Filing Extensions: A Temporary Lifeline

If you need an extension to file your taxes, the process for both paper and electronic filing remains similar. For a paper extension, you’ll complete and mail the extension form to the same address as your regular paper return. However, completing the extension only gives you more time to file. It does not grant you an extension to pay your taxes, so make sure you submit your payment by the initial deadline. For an electronic extension, your tax preparation software or online service should handle the process for you, eliminating the need for manual submission.

Avoiding Common Mistakes: Essential Tips for Filing Success

Here are some helpful tips to ensure your Colorado state tax return is processed smoothly:

- Double Check Your Address: Always confirm the correct mailing address before sending your paper tax return. Mistakes can lead to delays and penalties, and in some cases, even the rejection of your return.

- Include the Right Forms: Ensure you include all the necessary forms with your tax return. Missing forms can result in processing delays, so make sure you have every required document.

- Include Your Correct Social Security Number: Accuracy is paramount – double-check that you have included your Social Security Number (SSN) correctly for both you and your dependents. Errors in your SSN can cause significant complications.

- File on Time: It is crucial to file your taxes by the deadline, which is usually April 15th. Failing to meet this deadline can result in penalties, so it’s vital to plan and file early.

- Keep Copies For Your Records: Always retain copies of your tax return and all related documents. Having these records on hand helps you track your filing status and ensure you can easily access relevant information if needed.

Expert Insights and Actionable Advice

Tax filing can feel overwhelming, but by following these expert-backed strategies, you can navigate the process with ease:

- Contact the Colorado Department of Revenue: If you have any questions or doubts about your filing process, don’t hesitate to reach out to the Colorado Department of Revenue for assistance. They offer resources and support to ensure you understand your obligations and navigate the process effectively.

- Consider Professional Assistance: If you find the tax filing process daunting, or have complex tax situations, seeking professional assistance from a tax advisor or accountant can be invaluable. They can provide expert advice tailored to your specific circumstances, ensuring you file accurately and efficiently.

Where To Mail Colorado State Tax Return

Conclusion: A Smoother Filing Experience Awaits

Knowing where to mail your Colorado state tax return is a crucial step towards successful filing. Maintaining accurate addresses, reviewing your forms carefully, and retaining copies of your filings empowers you to navigate the tax process with confidence. By understanding the specific address requirements for your return, you can ensure it reaches its destination and avoid potential delays or penalties. Remember, if you face any uncertainties, utilize the resources available to you, including the Colorado Department of Revenue’s website or a qualified tax advisor. With the right information and preparation, you can navigate the Colorado tax system effectively and handle your financial obligations confidently.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)