Imagine you’ve just landed your dream job in Colorado, a state known for its stunning mountain ranges and vibrant cities. Excitement fills you as you picture a life surrounded by nature’s beauty. But as you begin the process of settling in, a question arises – how will Colorado’s taxes impact your finances? Understanding the state tax rate is crucial for budgeting and making informed financial decisions. This comprehensive guide will provide you with all the information you need about Colorado’s state tax rates in 2024, ensuring you’re equipped to navigate your financial journey in the Centennial State.

Image: brokeasshome.com

Colorado’s tax system is considered relatively straightforward compared to some other states, but it’s essential to understand its nuances. We’ll delve into the applicable tax rates for individuals and businesses, explore any potential changes to the tax code that may be implemented in 2024, and offer valuable tips to help you optimize your tax situation. By understanding the intricacies of Colorado’s tax landscape, you can gain a sense of financial clarity and peace of mind as you embrace your new life in the Centennial State.

Colorado Income Tax: Unraveling the Rates for Individuals

Colorado levies an income tax on individuals, with rates varying based on income levels. To provide a clear picture, let’s break down the tax brackets for 2024:

| Tax Bracket | Tax Rate |

|---|---|

| \$0 – \$10,000 | 4.5% |

| \$10,001 – \$30,000 | 4.6% |

| \$30,001 – \$75,000 | 4.7% |

| \$75,001 – \$125,000 | 5.1% |

| \$125,001 – \$250,000 | 5.3% |

| \$250,001 and above | 5.8% |

These rates are applied to taxable income, which is your total income minus any deductions and exemptions you are eligible for. For example, if your taxable income is \$50,000, you’ll pay 4.7% on the portion of your income between \$30,001 and \$75,000, and so on, according to the progressive tax structure.

Standard Deductions and Exemptions: Colorado offers a standard deduction, which is a set amount that taxpayers can subtract from their taxable income. The amount of the standard deduction varies based on filing status. Additionally, Colorado provides personal exemptions for dependents. These deductions and exemptions help reduce your tax liability, ultimately saving you money.

Understanding Colorado Sales Tax: A Guide to Consumption

Colorado has a state sales tax, which is levied on the sale of most goods and services. As of 2024, the state sales tax rate is 2.9%. However, remember that local jurisdictions, such as cities and counties, can impose their own additional sales taxes, making the effective sales tax rate higher depending on your location. This means you may experience different sales tax rates when purchasing items in Denver compared to those in rural areas of Colorado.

Exempt Items: While most goods and services are subject to sales tax, some items are exempt, such as groceries, prescription drugs, and clothing items under a certain price threshold. For a thorough understanding of exempt items, it’s advisable to check the Colorado Department of Revenue’s website.

Tax Relief for Seniors and Disabled Individuals

Colorado offers a state income tax deduction for seniors and individuals with disabilities to mitigate their tax burdens. If you are 65 years or older or have a qualifying disability, you can claim a deduction of \$3,000 for yourself. This valuable tax benefit can provide significant savings, easing the financial pressure often associated with aging or living with a disability.

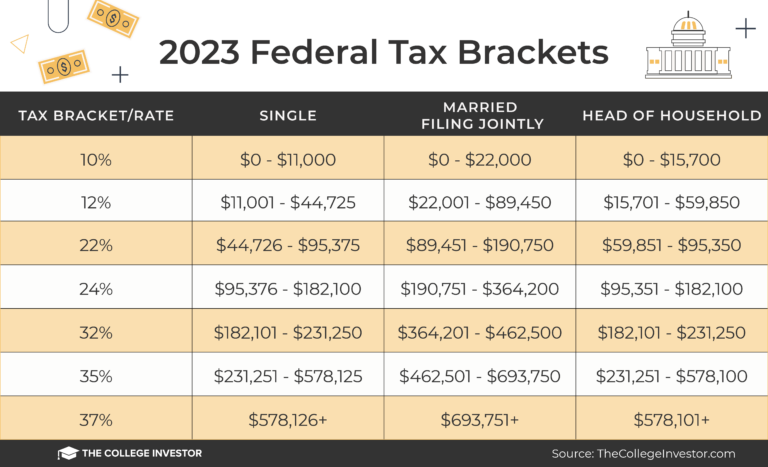

Image: thecollegeinvestor.com

Colorado Property Taxes: Understanding Your Tax Liability

Colorado levies a property tax on real estate, which includes both residential and commercial properties. The property tax rate is determined by local jurisdictions, such as counties and municipalities. These jurisdictions set their own tax rates based on their budget needs and property values within their respective areas.

Assessing Property Value: Local assessors determine the value of your property. This process involves evaluating factors like property size, condition, and market value, creating a baseline for property taxes.

Property Tax Rates: Colorado does not impose a statewide property tax rate. The rates are set by local governments and vary significantly across the state. It’s essential to check with your local county assessor’s office to ascertain the tax rate for your specific location.

Understanding Colorado’s Business Taxes: A Focus on Corporate Tax

For businesses operating in Colorado, there are various state taxes to be aware of. This includes a corporate income tax, which applies to corporations and limited liability companies (LLCs) that generate income in Colorado.

Corporate Tax Rate: For 2024, Colorado’s corporate income tax rate is 4.63%, applying to the corporation’s taxable income. This rate is significantly lower than the federal corporate income tax rate, making Colorado a relatively business-friendly state.

Other Relevant Taxes: Other taxes that businesses may encounter in Colorado include sales and use tax, property tax, and franchise tax. The specific tax obligations depend on the type of business and its activities.

Colorado’s Tax Code: Navigating Potential Changes

The Colorado General Assembly continually reviews and adjusts the state’s tax code. It’s possible that changes to tax rates or exemptions could be introduced in 2024.

Staying Informed: To stay updated on any changes to Colorado’s tax laws, it’s imperative to monitor announcements from the Colorado Department of Revenue and legislative updates.

Tax Planning and Optimization: Expert Tips for Colorado Residents

Optimizing your tax situation involves utilizing tax deductions and credits that are available to you.

Deductions and Credits: Colorado offers various deductions and credits for individuals and businesses, including deductions for charitable contributions, medical expenses, student loan interest, and energy-efficient home improvements.

Tax Professionals for Guidance: Seeking professional guidance from a tax advisor can help you identify eligible tax breaks and optimize your tax strategy.

What Is Colorado State Tax Rate 2024

Conclusion: Financial Clarity in the Centennial State

Navigating Colorado’s tax system requires understanding the state’s tax rates, deductions, and exemptions. This guide has provided a comprehensive overview of these key aspects. By staying informed and seeking professional advice when needed, you can navigate Colorado’s tax landscape with confidence and maximize your financial well-being.

Remember, the Colorado Department of Revenue is a valuable resource for obtaining accurate and up-to-date tax information. Don’t hesitate to leverage this resource to ensure compliance and maximize your tax benefits. As you embark on your journey in the Centennial State, armed with this knowledge, you can confidently manage your finances and enjoy the countless opportunities that Colorado has to offer.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)