Ever found yourself staring at the checkout counter, wondering where that extra bit of change went? Well, in Colorado, the culprit is often sales tax. This little number can add up quickly, especially for big purchases, but understanding how it works can help you budget and avoid surprises. Today, we’ll dive into the world of sales tax in Colorado, exploring its intricacies and how it impacts your wallet.

Image: printableformsfree.com

Colorado’s sales tax system is a dynamic network, with elements ranging from state-level levies to local additions. Understanding the nuances of this system is crucial for both businesses and consumers, allowing you to navigate financial obligations and make informed purchasing decisions.

The Foundations of Colorado Sales Tax

State Sales Tax

At the heart of Colorado’s sales tax system lies the state sales tax, currently set at 2.9%. This tax applies to most tangible goods purchased in the state. This means that when you buy a new pair of jeans, a laptop, or even groceries, you’ll pay 2.9% of the purchase price to the state of Colorado.

It’s important to note that while the state sales tax is a relatively small percentage, it can accumulate quickly, especially for large purchases. However, the state sales tax is not a flat rate across the board. Certain items are exempt from this tax. For example, prescription medications, groceries (excluding prepared foods), and clothing items under a certain price threshold are generally exempt.

Local Sales Taxes

Beyond the state sales tax, Colorado allows local governments, such as cities and counties, to implement their own local sales taxes. These taxes are often called “use taxes” and can vary significantly depending on your location.

The range of local sales taxes can be substantial. Some areas may have no additional local tax, while others could charge an additional 3% or even higher. It’s essential to check the local sales tax rate before making a large purchase, especially if you’re shopping in a different city or county.

Image: www.co.grand.co.us

How to Calculate Total Sales Tax

Determining the total sales tax on your purchase involves a simple calculation. Here’s how it works:

- Determine the state sales tax: Multiply the price of your purchase by the state sales tax rate (2.9%).

- Determine the local sales tax: Multiply the price of your purchase by the local sales tax rate (this varies by location).

- Calculate the total sales tax: Add the state sales tax and the local sales tax together.

- Calculate the final price: Add the total sales tax to the original purchase price.

For instance, imagine you’re buying a $100 shirt in Denver. The state sales tax would be $2.90 (100 x 0.029). Denver’s local sales tax rate is currently 4.5%, making your local sales tax $4.50 (100 x 0.045). The total sales tax would be $7.40 ($2.90 + $4.50), making the final price of the shirt $107.40 ($100 + $7.40).

Understanding Sales Tax Exemptions

While most items are subject to sales tax in Colorado, certain goods and services are exempt. Knowing these exemptions can save you money, especially for larger purchases. Here are some common categories of sales tax exemptions:

- Groceries: While prepared foods are generally taxable, most unprocessed groceries are exempt from sales tax. This includes staples like milk, bread, and produce.

- Prescription Medications: Medications prescribed by a doctor are exempt from sales tax.

- Clothing: Clothing items under a certain price threshold (currently $110) are exempt from sales tax.

- Services: Many services, such as haircuts, medical treatments, and legal advice, are exempt from sales tax.

Keep in mind that these exemptions can change over time, so it’s best to stay updated with the latest regulations.

Navigating Sales Tax in Specific Situations

The sales tax landscape in Colorado can be complex, especially for certain circumstances. Here’s a breakdown of sales tax in specific scenarios:

Online Purchases

If you’re buying goods online from a vendor located outside of Colorado, you might still be subject to sales tax. This is because Colorado requires individuals to pay use tax on items purchased out-of-state, regardless of whether the vendor collected sales tax at the point of purchase.

It’s your responsibility to report and pay use tax on these purchases, but the Colorado Department of Revenue provides resources and guidance to help you navigate this process.

Vehicle Purchases

Buying a car in Colorado comes with its own set of sales tax rules. The state sales tax applies to the purchase price of the vehicle, as well as any additional fees like registration and title fees.

Local sales taxes also apply to vehicle purchases, meaning your final sales tax burden could be higher than a typical purchase.

Sales Tax and Business Operations

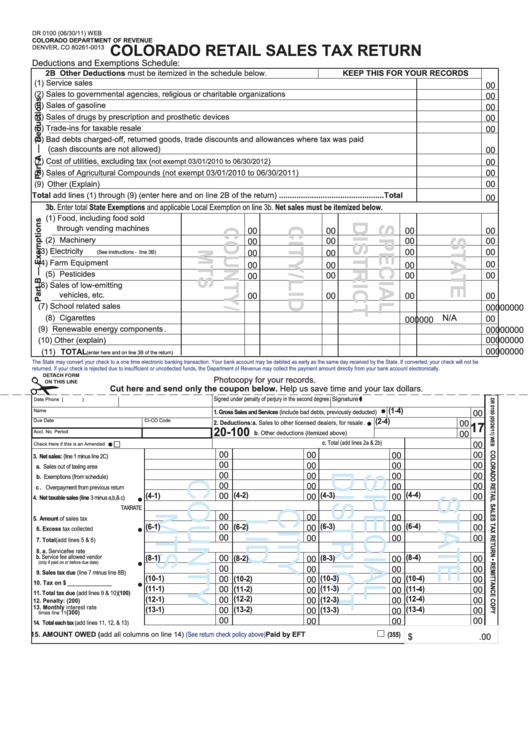

Understanding sales tax is crucial for businesses operating in Colorado. Businesses are responsible for collecting sales tax from customers and remitting those funds to the state.

Companies must register with the Colorado Department of Revenue to collect and pay sales tax. They also need to maintain accurate records of their sales and sales tax collected.

Businesses can face penalties for failing to comply with sales tax requirements, so it’s essential to understand their obligations and seek help if needed.

The Future of Sales Tax in Colorado

The sales tax system in Colorado is constantly evolving, with ongoing discussions about potential changes and modifications. For example, there have been proposals to expand the sales tax base to include more services, such as streaming services and online advertising.

Understanding these potential changes is essential for individuals and businesses alike, as they could impact the way sales tax is collected and paid in the future.

What Is The Sales Tax In Colorado

Conclusion

Navigating the sales tax landscape in Colorado can be a journey. However, understanding the fundamentals of state and local sales taxes, exemptions, and the implications for businesses and individuals, you can make informed purchasing decisions and navigate this system with confidence.

The best way to stay informed about Colorado’s sales tax regulations is to visit the Colorado Department of Revenue website or consult with a tax professional. And remember, knowing your rights and obligations can save you money in the long run!

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)