Imagine this: you’re at the register at your local Dollar General, a familiar shopping destination for everyday essentials. You’re not just grabbing groceries; you’re also thinking about your future. As a Dollar General employee, you have access to a valuable tool for achieving your financial goals: the Dollar General 401(k) plan. But navigating any retirement plan, even one as widely accessible as Dollar General’s, can feel overwhelming at first.

Image: www.insurancediaries.com

That’s where this guide comes in. We’ll take you through the process of logging into your Dollar General 401(k) account, understanding your investment options, and making choices that help you reach your retirement aspirations.

The Power of the Dollar General 401(k): Your Path to a Secure Future

The Dollar General 401(k) plan is a powerful tool for securing your financial future. It allows you to set aside a portion of your pre-tax earnings, which are then invested in a diversified portfolio of mutual funds. The magic of investment compounds over time, meaning your money grows more exponentially than if you simply kept it in a bank account. Plus, you enjoy tax benefits on the way to retirement, making it a compelling option for building a solid financial foundation.

Getting Started: Accessing Your Dollar General 401(k) Account

The first step to managing your 401(k) is accessing your account. To log in, you’ll need a few key pieces of information:

- Your Dollar General Employee ID: This number is your unique identifier within the company’s system.

- Your Social Security Number: This is the cornerstone of financial identification that links your account to you.

- Your Date of Birth: This helps ensure the correct account is accessed.

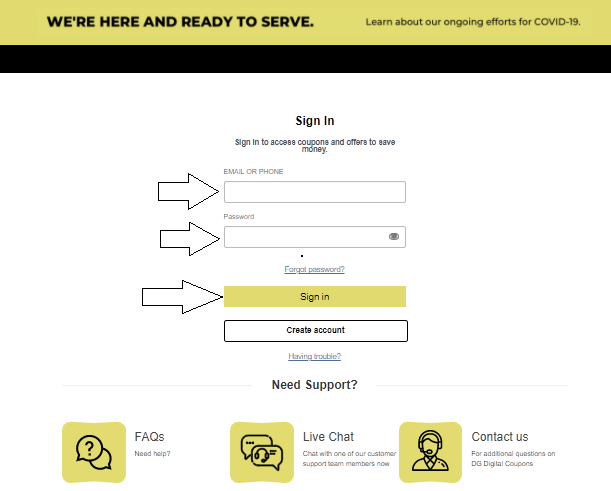

Step-by-Step Guide to Log In:

- Visit the Dollar General 401(k) Website: The website address will be provided during your onboarding process.

- Click on the “Login” Button: You’ll usually find this on the top right corner of the home page.

- Enter Your Login Credentials: Type in your employee ID, Social Security Number, and date of birth.

- Confirm Your Identity: In some cases, you may need to verify your identity through a security question or a unique PIN code to access your account.

Image: takesurvery.com

Understanding the Components of Your Dollar General 401(k)

Upon logging in, you’ll find a dashboard with key information about your 401(k), including:

- Balance: This reflects the current value of your account.

- Contributions: This shows how much you’ve contributed to the plan so far.

- Investment Options: This typically displays a selection of mutual funds you can invest in.

- Performance: This section tracks the growth of your investments over time.

Dive Deeper: Exploring Your Investment Options

Your investment options within the Dollar General 401(k) are the building blocks of your retirement savings. Here’s how to approach them:

- Understand the Basics: Familiarize yourself with the different types of mutual funds available, such as:

- Stock Funds: Invest in shares of publicly traded companies.

- Bond Funds: Invest in debt securities, offering more stability than stocks.

- Target-Date Funds: Automatically adjust your asset allocation over time based on your retirement date, offering a set-and-forget option.

- Seek Expert Guidance: If you’re new to investing, don’t hesitate to request help from the Dollar General 401(k) administrator or consult with a financial advisor to understand which options best fit your risk tolerance and timeline.

- Diversify Your Portfolio: Spread your investments across various types of assets to minimize risk.

Planning for Success: Setting Up Your Dollar General 401(k)

Once you’ve familiarized yourself with the investment options, it’s time to start maximizing your retirement savings:

- Set a Contribution Rate: Aim to contribute regularly, even if it’s a modest amount at first.

- Consider Automatic Enrollment: TheDollar General 401(k) plan may offer an automatic enrollment option, making it easier to start contributing right away.

- Utilize Matching Contributions: If your employer offers matching contributions, make sure you’re taking advantage of this free money!

- Adjust Your Investment Allocation: Periodically review your investment mix and make adjustments as needed to align with your individual goals and risk tolerance.

Beyond Login: Building a Retirement Strategy

While logging into your Dollar General 401(k) account is a great starting point, it’s critical to think about the bigger picture:

- Time Horizon: How many years until you retire?

- Risk Tolerance: How comfortable are you with potential fluctuations in your investment value?

- Financial Goals: What kind of lifestyle are you hoping for in retirement?

Dollar General 401k Login

Dollar General 401(k) Resources at Your Fingertips

You’re not alone in this journey. Dollar General provides resources to help you navigate your 401(k) with confidence.

- Online Help Center: This is a valuable repository of information about the plan, from login assistance to investment guidance.

- Contact Support: If you have questions or need help making decisions, reach out to the Dollar General 401(k) administrator for personalized support.

Your Future is Within Reach:

Logging into your Dollar General 401(k) is the first step toward securing your financial future. By understanding the components of the plan, making informed investment choices, and utilizing the resources available to you, you can create a path towards a comfortable and prosperous retirement.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)