Remember that frantic feeling of scrambling to meet the deadline for your annual health insurance enrollment? That rush, that sense of urgency, that’s what we call “Login Season.” It’s that whirlwind of deadlines and decisions that come with enrolling in benefits for your health, dental, vision, and more. It can feel like a chore, a confusing bureaucratic process, but it’s also a chance to make vital choices for your well-being and your family’s.

Image: webhelp.fred.com.au

This guide delves into the world of Login Season, unpacking the complexities and providing insights to help you navigate this annual ritual with confidence. We’ll explore the different stages of enrollment, unveil the key factors influencing your choices, and offer actionable tips for making the most of your benefits package.

Understanding the Basics: The Stages of Enrollment

Login Season is typically marked by a specific period every year when you can choose or adjust your benefits for the following year. It’s a time for a deep dive into your health insurance options, retirement plans, and other perks offered by your employer. The process usually unfolds in phases:

- Open Enrollment: This is the official window when you can make changes to your benefits for the next year. Employers will typically announce open enrollment dates, giving you a clear time frame to make your decisions.

- Plan Selection: The heart of Login Season is choosing the best plan for you and your family. This involves researching different options, evaluating coverage, and considering costs.

- Benefit Allocation: Once you’ve chosen your health insurance, you might have the chance to allocate funds towards other benefits like dental, vision, or flexible spending accounts.

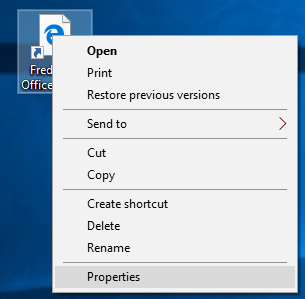

- Enrollment Confirmation: After making your selections, you’ll need to confirm your choices through your employer’s benefits portal.

Navigating the Maze: Key Factors to Consider

The choices you make during Login Season can have a significant impact on your wallet and well-being. Here’s a breakdown of crucial factors to weigh as you navigate the decision-making process:

- Health Needs: Your health history and current medical needs are paramount. If you have pre-existing conditions or anticipate needing extensive medical care, you’ll want to choose a plan with comprehensive coverage.

- Cost Considerations: Premium costs, deductibles, coinsurance, and out-of-pocket expenses will all play a role in your decision. A higher premium might imply lower out-of-pocket costs, and vice versa.

- Coverage Levels: Plans vary in the services they cover. Some offer very basic coverage, while others provide extensive benefits. Choose a plan that aligns with your typical healthcare needs.

- Network Access: Ensure your preferred doctors and hospitals are within your chosen plan’s network. Out-of-network care can be expensive, so carefully consider your access to healthcare providers.

- Retirement Planning: This includes deciding on your contribution levels to your 401(k) or other retirement savings plans offered by your employer.

- Flexible Spending Accounts (FSAs): These accounts allow you to set aside pre-tax money for eligible health care and dependent care expenses.

- Life Insurance: If you’re covered by your employer, consider your existing policy. If not, explore options for life insurance coverage.

Expert Insights and Actionable Tips

Don’t be intimidated by the complexity of Login Season. Here’s some expert advice to make the process smoother:

- Start Early: Don’t wait until the last minute. Give yourself ample time to research options, understand coverage details, and make informed decisions.

- Utilize Resources: Your employer’s HR department can provide valuable information, and online resources like the Employee Benefits Security Administration (EBSA) offer helpful guidance.

- Consult a Broker: If you find the process overwhelming, consider enlisting the help of a benefits broker. They can guide you through the complexities and help you find the best plan for your needs.

- Ask Questions: If something isn’t clear, don’t hesitate to ask for clarification. Your employer’s benefits team is there to help you understand your options.

- Review Your Coverage: Once you’ve enrolled, don’t forget to review your coverage periodically. Life changes, like a new baby or a change in your health status, might require adjusting your plan.

Image: proresplus.com

Login Season Org

Empowering Yourself During Login Season

Login Season may feel like a bureaucratic hurdle, but it’s a chance to make informed choices that directly impact your well-being and financial security. By understanding the key factors, utilizing available resources, and asking questions, you can navigate the process effectively. Remember, your health and your future are worth the investment of time and research. Take control of your benefits, feel confident in your choices, and make the most of the opportunities available to you during Login Season.

/GettyImages-173599369-58ad68f83df78c345b829dfc.jpg?w=740&resize=740,414&ssl=1)